If you need to raise capital fast, a traditional stock offering or initial public offering isn’t the way to go. Instead, consider a private stock offering or private placement. A private stock offering enables you to generate capital in days rather than weeks or months.

In this case, you reach out to preferred private investors with an exclusive stock or bond offering. Let’s take a look at how the process works.

Procedure of Offering a Private Stock Offering

Here’s the good news. A private stock offering has few regulatory requirements, as outlined under Regulation D. Although it involves the sale of securities, you’re dealing with mostly accredited investors who understand the risks. Therefore, you often don’t have to register the sales with the Securities and Exchange Commission. Additionally, you won’t need to produce an as advanced prospectus about the deal.

Both private and public companies can utilize the private stock offering. It allows private companies to stay private, and public companies can use it to work with investors they already have lined up to generate funds quickly.

The Securities Act of 1933 governs public stock offerings. The act was created to safeguard the market against the stock runoff that led to the 1929 crash. However, there are exemptions for private placement offerings.

Here are the details:

- Private and public companies can select investors for private stock offerings not available to the general public.

- Only an accredited investor (someone with $1 million in net income or a salary of more than $200,000 for the last three years) can participate in the sale. This could include venture capital firms.

- Startups can generate capital using private stock offerings. This allows you to keep your company off the public exchange.

- Regulation D private placements, private placements can occur with lightning speed, even within ten days.

- It allows you to speed up the underwriting process and, for bonds, save money by skipping the credit rating.

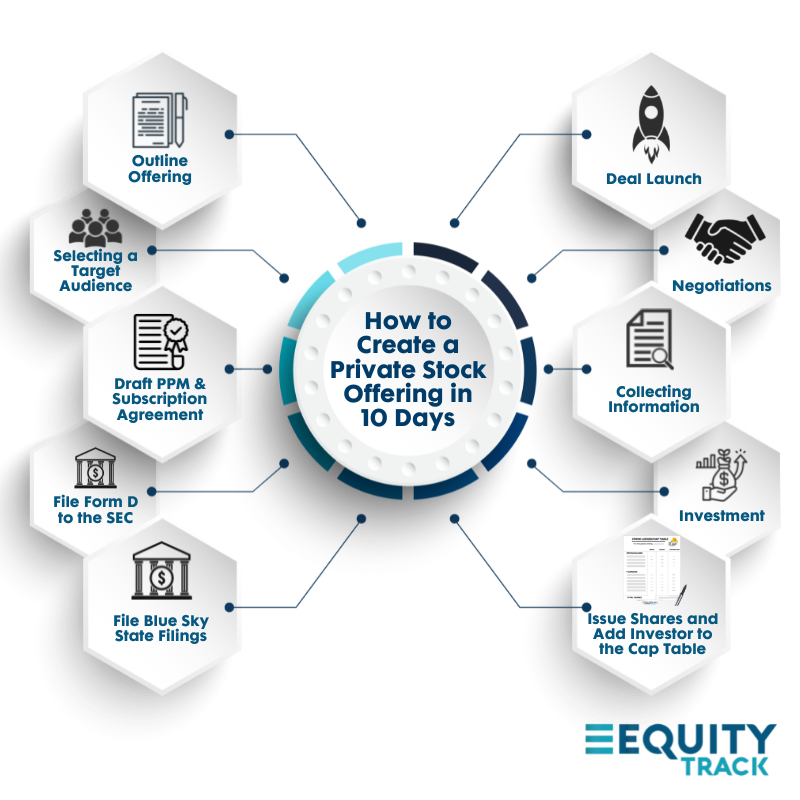

Here are the steps to completing a private stock offering:

- Outline Offering: Management will work with its Board of Directors and Legal Counsel to determine the basic structure of the offering that will be pitched to investors. This includes the number of shares offered, price per share, the total dollar offering amount (how much money do you need to raise?), any derivatives such as warrants or other bonuses for investing, and targeted audience.

- Selecting a Target Audience: Depending on the type of Regulation D exemption that the company utilizes, the targeted audience might be different. Some non-accredited investors may be allowed in some cases where only accredited investors are allowed in others. Accredited investors may also include institutional investors such as VCs, private equity, investment banks, and more. Typically, larger banks will not invest in your company unless it is publicly traded.

- Draft PPM and Subscription Agreement: Your attorney will then draft the offering documents that will be supplied to shareholders and in some cases filed to the regulators, as required.

- File Form D to the SEC: Reg D requires companies to file the Form D to the SEC within 15 days of the first sale. It is recommended to pre-file as some states may require pre-filing as well.

- File Blue Sky State Filings: After you have filed the Form D, file disclosures of your offering to the states. Every state has different requirements. A compliance expert to handle these filings for you is recommended. Learn more

- Deal Launch. Once filings and offering is setup, you can begin reaching out and marketing your offering to investors. This step sets a timeframe in which investors must decide to take the offer or not.

- Negotiations. Some investors may require negotiation especially large institutional investors.

- Collecting Information. During this time, investors investigate the company. This might include analyzing financial statements, meeting with management, conducting industry analysis, or determining the company’s market position.

- Investment. When an investor subscribes to your offering, they will purchase the shares by sending funds to you.

- Issue Shares and add Investor to the Cap Table. You will then be responsible to issue the shares to them compliance with SEC and UCC regulations. An SEC registered transfer agent can help you do this.

Allocation and Pricing

In return for handing over their money in a rush and assuming greater risk, private placement investors, especially VCs and private equity firms, typically require an above-market interest rate. For bond issues, private placement buyers may ask for specific collateral to hedge their risks. Alternatively, stock investors in private stock offerings may ask for a greater share of equity or fixed dividends per share.

When publicly traded companies issue private stock offerings, other shareholders typically realize a decrease in value. The hope is that the company will experience an increase in performance as a result of the infusion of capital. Therefore, existing stockholders and those holding the private placement could make out well in the long term.

As you can see, this makes it important to limit private stock offerings for critical business needs that can improve revenue and profit.

Additional Information and Resources

Issues must follow the rules under the Securities Act of 1933 (Regulation D), but there are exemptions for private stock offerings. Learn more about the FINRA exemptions for private placements here.